About

Sony’s US mobile phone market share is low, as is general brand awareness for Sony. We came in to where Sony stands among its competitor from design point of view.

Client / Sony Agency / ustwo Year / 2015 My role / UX, research

Research methods we used

Observed Sony’s mobile device retail presence

We visited a few major electronic stores that sell Sony device in order to understand how the brand is being perceived by the public and how the brand speaks for itself in a physical place.

Comparative reviews

We compared the Sony device with 5 competitor devices, reviewing hardware and software factors to identify how Sony compares against these devices.We used a tournament-style approach for this, where two devices are compared to each other at a time and a winner picked.

Amazon meta review

We looked at 99 Amazon reviews across 4 Sony smartphones. We discarded any reviews that discussed shipping or store issues, and also any reviews that suggested a defective device that should be returned under warranty.

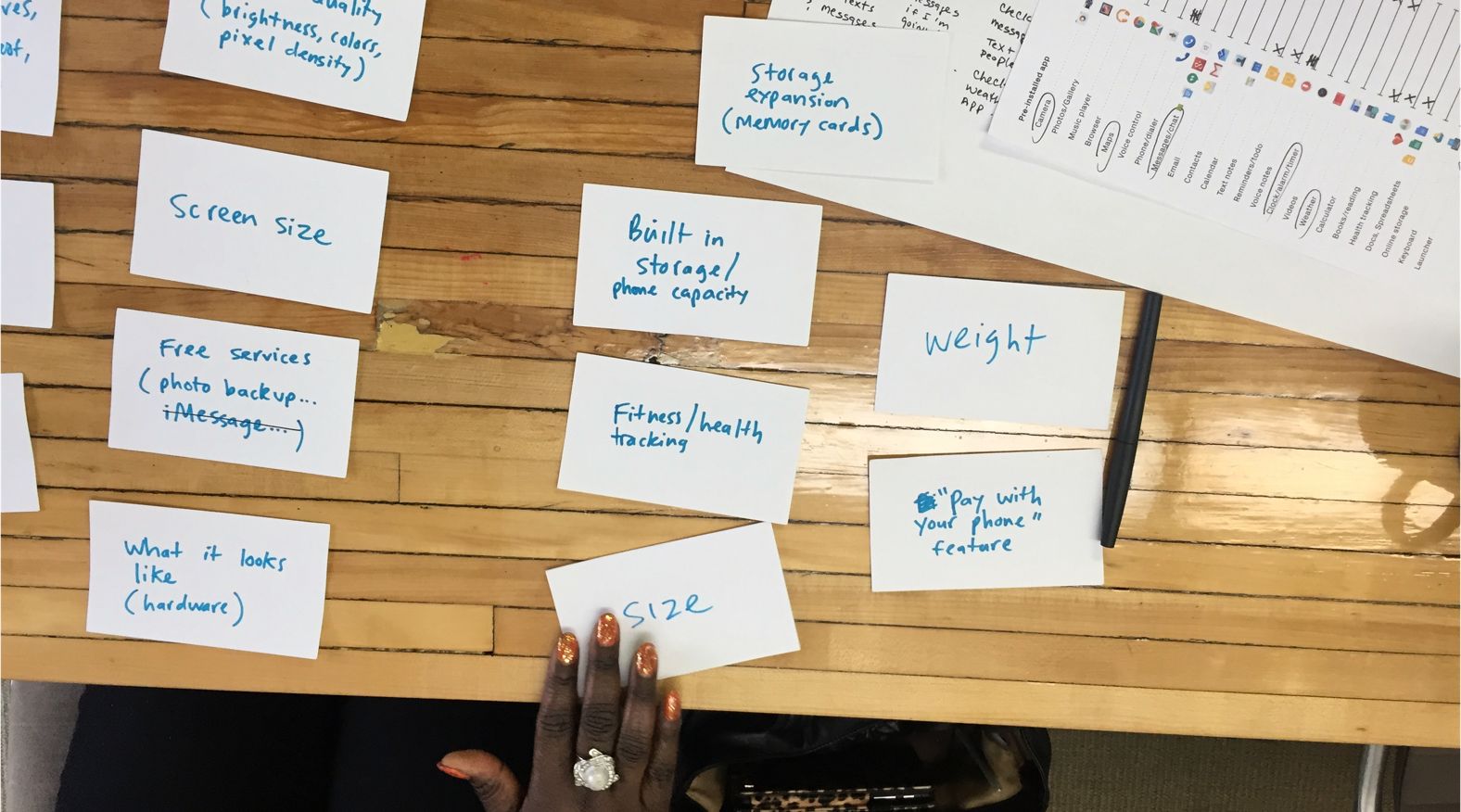

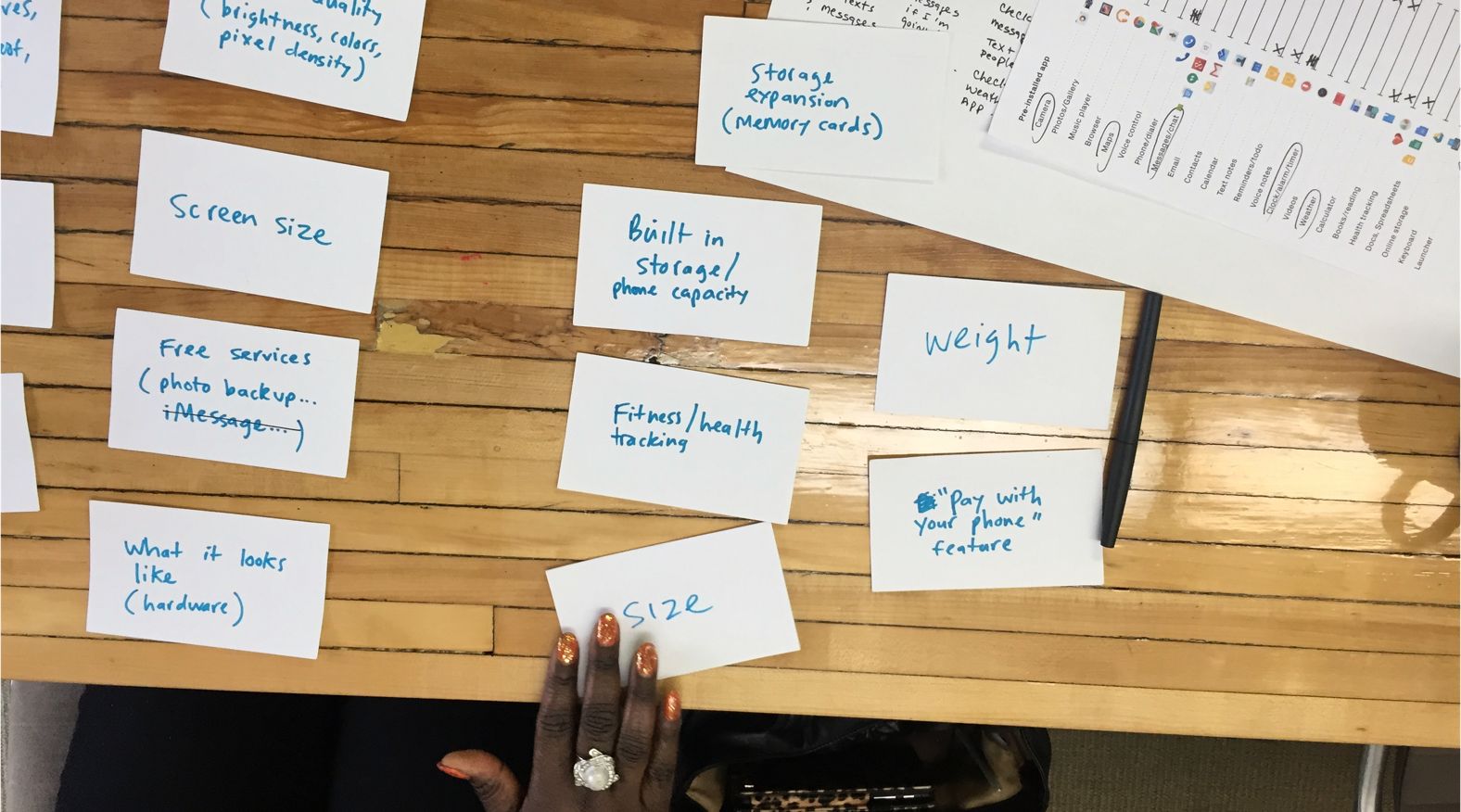

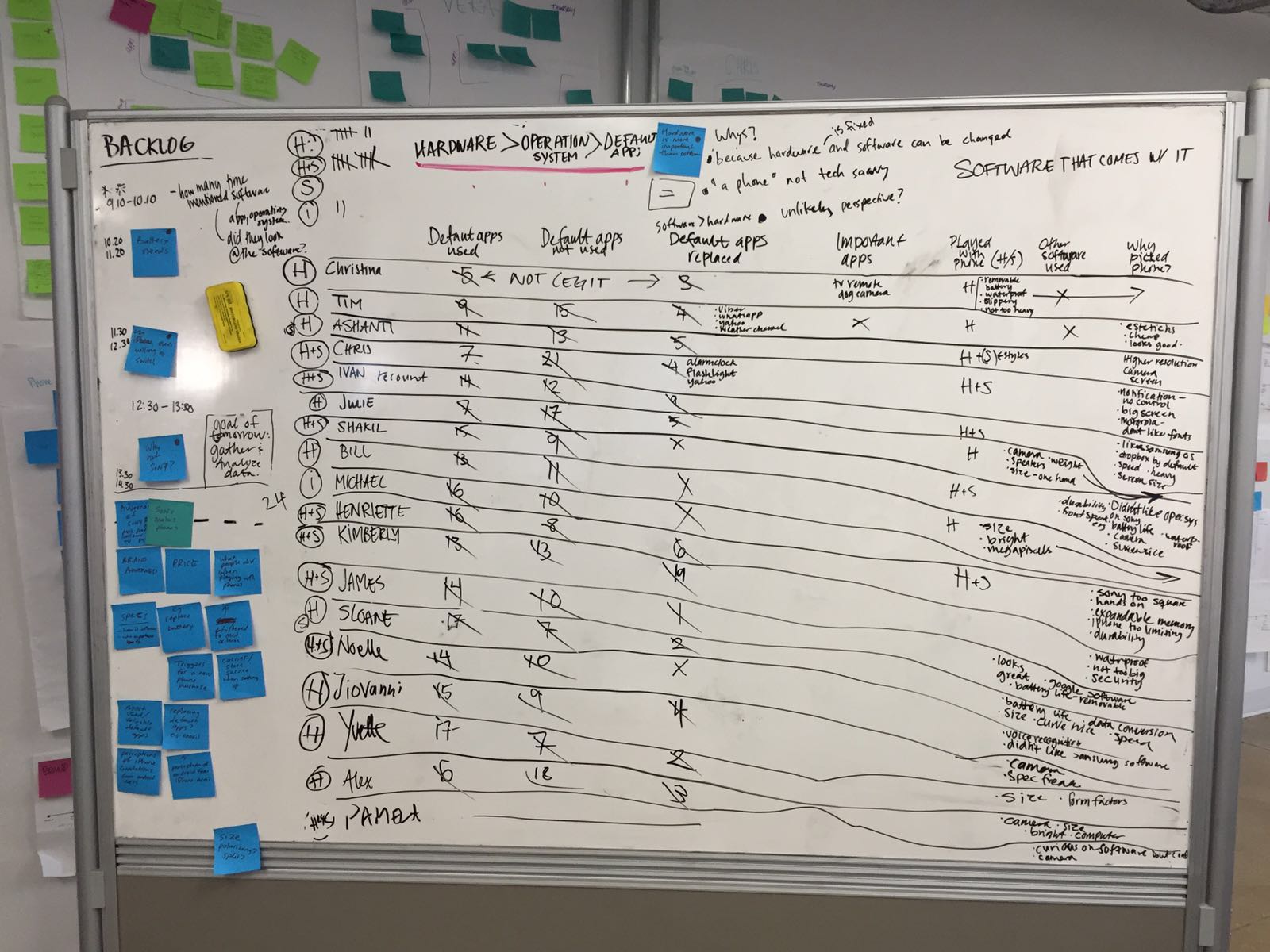

In person interview

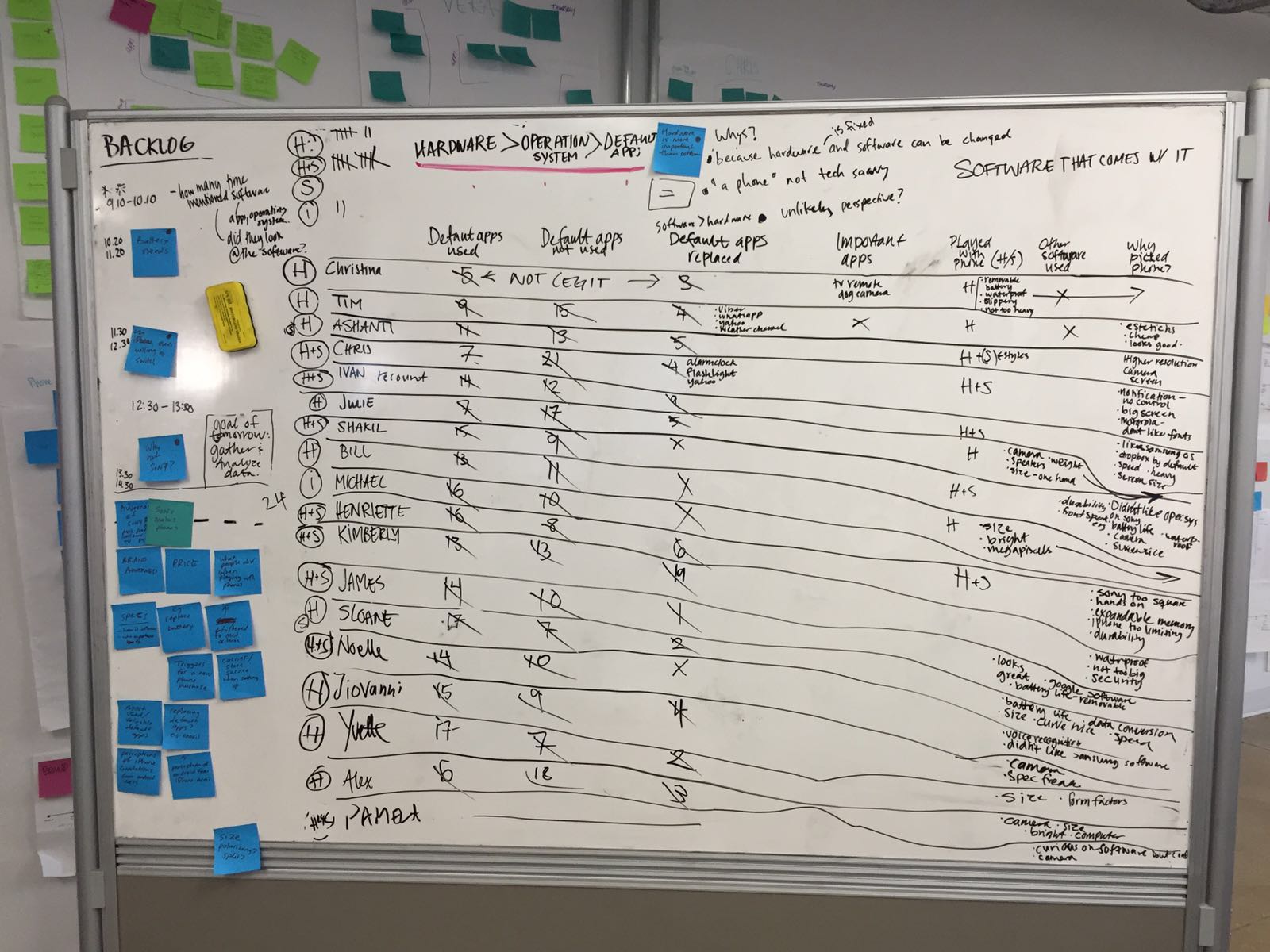

We recruited 20 people in New Jersey and New York who had considered buying a Sony phone in the past 6 months, but ultimately went with a competitor. We conducted some engaging activities to capture people’s relationship with their devices, their needs and feature prioritization when it comes to buying a new phone.

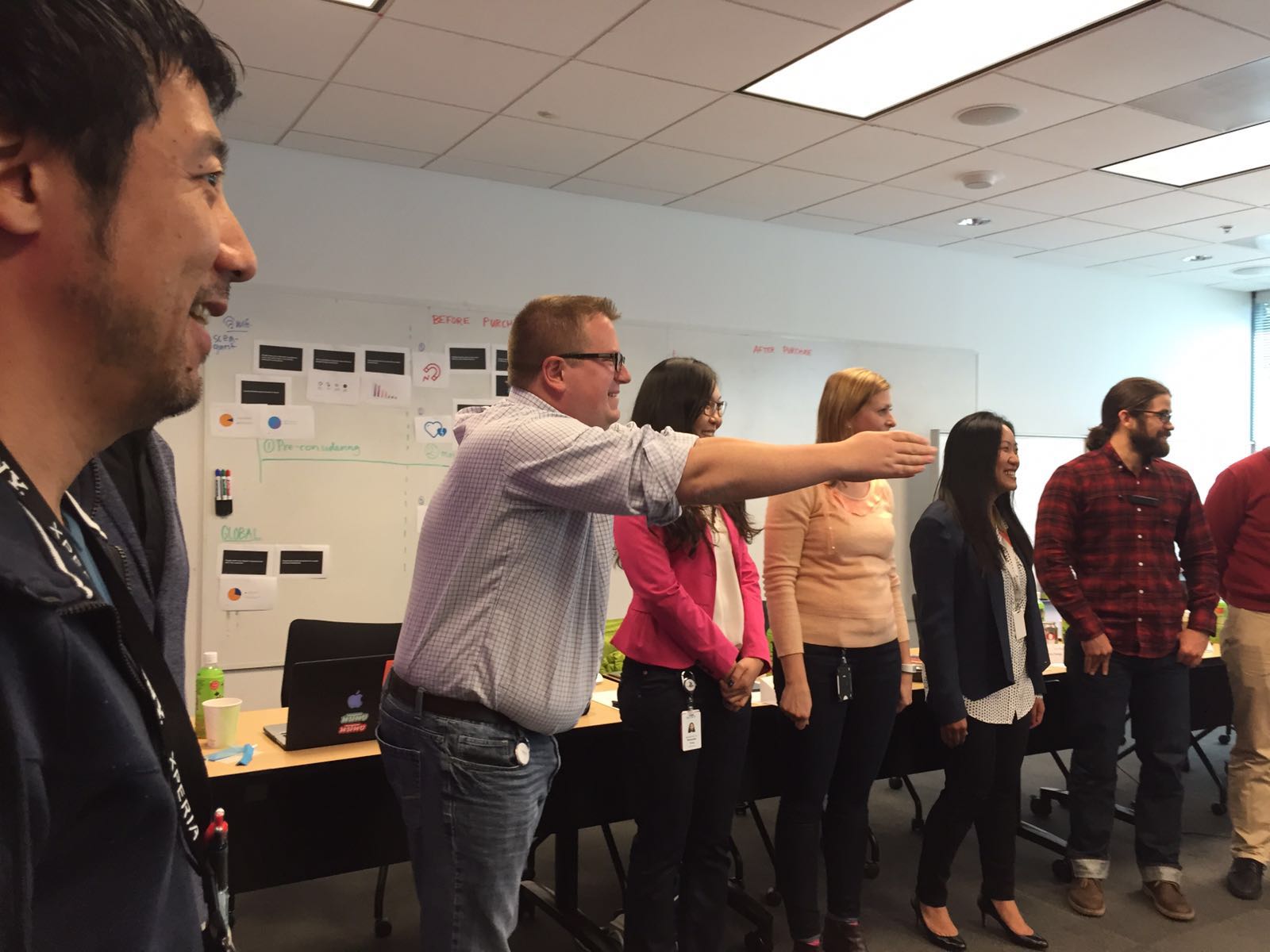

Outcome

We wrapped up the project with a thorough report and a two-day workshop with the clients onsite. Clients really liked our presentation format and thought the commen language we established for they are great tools to be used communicateing within the organization since the company is so big. It is also an eye opening expereince for them to look at their work from a third party which help them understand where the problems are.